- News

- Reviews

- Bikes

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Tubeless valves

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

news

Halfords barrier logo 3x2 (copyright Simon MacMichael)

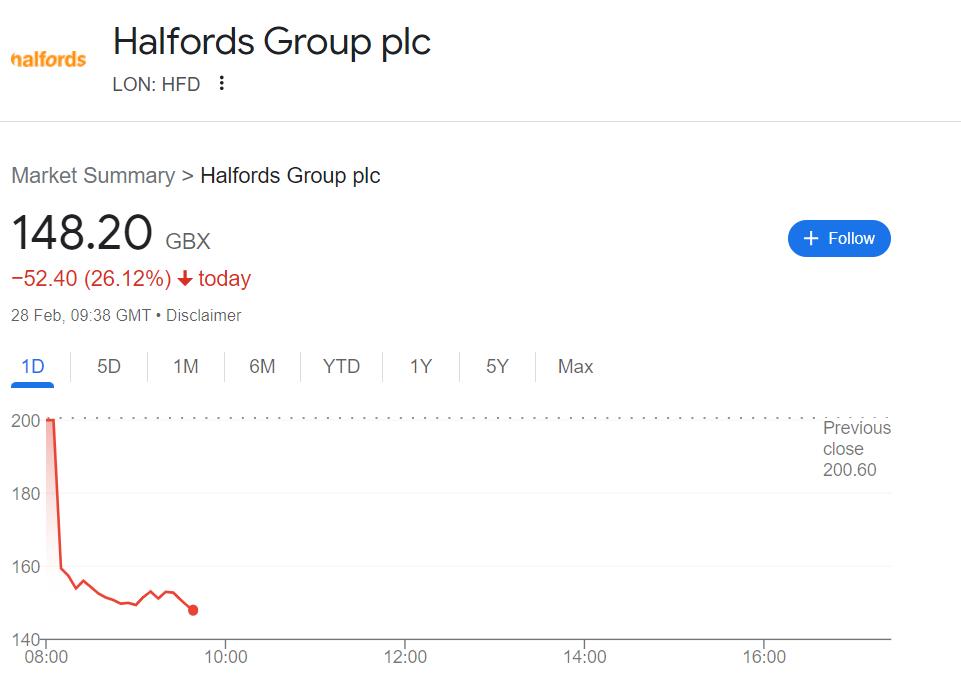

Halfords barrier logo 3x2 (copyright Simon MacMichael)Halfords share price plunges 25% as retailer downgrades profit forecast amid continued weak cycling demand

The share price of the UK's largest retailer of cycling products and services, Halfords, has plummeted following an announcement from the business that amid a slow start to the calendar year its profit forecast has been downgraded by at least 17 per cent.

Halfords' share price has fallen as low as 140 pence this morning, more than 25 per cent down on its closing price of 200 pence, and hitting its lowest level since October 2022. The market reacted to Halfords revealing that its January sales had disappointed, with cycling-related sales eight per cent lower than in the same month last year. Elsewhere, motoring sales were down five per cent, while tyre sales were down four per cent.

In its latest quarterly accounts, released last month, the company reported its bike market had performed "significantly worse than anticipated", a trend that appears to have continued into 2024.

Now, Halfords has blamed poor weather for hitting its business, rain and warmer temperatures meaning lower footfall in its shops and reduced sales of anti-freeze.

Consequently, for the current financial year, to March 29, Halfords has downgraded its pre-tax profit forecast to £35-40 million, down from at least 17 per cent from the £48-53 million figure given last month. Looking to the future, Halfords predicted that the 2025 financial year would be broadly similar to 2024, suggesting the bike industry's recovery following a few challenging years may have some way to go yet.

"While our macro indicators for disposable income growth this year are all lit up green, which bodes well for spending power into the second half of 2024, consumers still remain cautious, shopping by need," Peel Hunt analysts told Reuters of the situation at Halfords, noting that taking market share is a positive, but customers continue to count costs and shop "by need" given the economic picture.

Halfords' share price boomed during the pandemic, rising from 66 pence in March 2020 to a high point of 434 pence in July of the following year. It experienced a steady fall in the 12 months following that peak, before staying fairly consistent in the 18 months preceding today's drop.

Last year, amid poor cycling performance, the business said it would focus on "needs-based" sources of revenue, such as cheap motoring repairs, in a bid to fill the gap left by "discretionary" spending areas, such as cycling and car cleaning, which were "adversely affected by unfavourable weather and low consumer confidence".

The noises last June were, however, that in the long term Halfords remains "very, very confident" about the cycling market. "Cycling still hits the sweet spot in terms of climate change… We still think it's the right place to be," the retailer's chief executive Graham Stapleton said at the time.

Those comments came a year after, in June 2022, the company warned of a "considerable softening of the cycling market" following its pandemic boom, with supply chain disruption and inflation beginning to bite.

Dan is the road.cc news editor and joined in 2020 having previously written about nearly every other sport under the sun for the Express, and the weird and wonderful world of non-league football for The Non-League Paper. Dan has been at road.cc for four years and mainly writes news and tech articles as well as the occasional feature. He has hopefully kept you entertained on the live blog too.

Never fast enough to take things on the bike too seriously, when he's not working you'll find him exploring the south of England by two wheels at a leisurely weekend pace, or enjoying his favourite Scottish roads when visiting family. Sometimes he'll even load up the bags and ride up the whole way, he's a bit strange like that.

Latest Comments

- momove 12 min 45 sec ago

Precisely on point about the parking. There'd be almost no issues if all the space allocated to car parking was provided for bike parking instead....

- Pedal those squares 27 min 15 sec ago

IMHO he should be prosecuted to the full extent possible and band from all sporting events for a VERY long time. Otherwise there is no real...

- Spangly Shiny 43 min 18 sec ago

I'm pretty sure the dear lady is still very much alive and kicking. Reports of her demise are at least, a tad premature.

- chrisonabike 42 min 40 sec ago

What is "progress" though?...

- Secret_squirrel 2 hours 47 min ago

Thats if you believe that a slightly bigger bearing surface translates in any meaningful way to "pedaling stiffness" which to my mind is the...

- chrisonabike 2 hours 53 min ago

Everyone carrying more / brighter searchlights will fix things? Perhaps it helps sometimes, but I think this leads to other issues. We're already...

- SecretSam 2 hours 55 min ago

Lake's naming and sizing: never knowingly comprehensible. Good shoes, baffling range.

- hawkinspeter 2 hours 58 min ago

Yeah, I doubt if Arron Banks would be happy visiting "little Somalia" (as he referred to Bristol) and certainly I don't think Bristol's residents...

- ChasP 3 hours 35 min ago

It could be used as a reliable comparison without any calculations.

Add new comment

4 comments

The recent 25% plunge in Halfords' share price following their profit forecast downgrade is a stark reminder of the challenges facing the retail sector, especially in the cycling segment. This downturn reflects not just seasonal fluctuations but possibly deeper issues with consumer spending habits and market saturation. This incident underscores the volatility of market demands and the critical need for agile pricing strategies. My journey mirrors this challenge, grappling with maintaining competitive pricing in an ever-shifting market. That's until I discovered Priceva. Priceva revolutionized how I approach pricing. The convenience of automated price monitoring and receiving daily reports meant I could focus more on strategy and less on the manual tracking of competitor prices.

As there are no independent shops here, I have started using Halfords for bike bits.

Truly we have entered the rapid decline of Western civilisation

Is that the period when we have a few extremely high-end luxe retail outlets but then everything else is owned by Mike Ashley?