- News

- Reviews

- Bikes

- Accessories

- Accessories - misc

- Computer mounts

- Bags

- Bar ends

- Bike bags & cases

- Bottle cages

- Bottles

- Cameras

- Car racks

- Child seats

- Computers

- Glasses

- GPS units

- Helmets

- Lights - front

- Lights - rear

- Lights - sets

- Locks

- Mirrors

- Mudguards

- Racks

- Pumps & CO2 inflators

- Puncture kits

- Reflectives

- Smart watches

- Stands and racks

- Trailers

- Clothing

- Components

- Bar tape & grips

- Bottom brackets

- Brake & gear cables

- Brake & STI levers

- Brake pads & spares

- Brakes

- Cassettes & freewheels

- Chains

- Chainsets & chainrings

- Derailleurs - front

- Derailleurs - rear

- Forks

- Gear levers & shifters

- Groupsets

- Handlebars & extensions

- Headsets

- Hubs

- Inner tubes

- Pedals

- Quick releases & skewers

- Saddles

- Seatposts

- Stems

- Wheels

- Tyres

- Health, fitness and nutrition

- Tools and workshop

- Miscellaneous

- Cross country mountain bikes

- Tubeless valves

- Buyers Guides

- Features

- Forum

- Recommends

- Podcast

news

bike-commuter-1.jpg

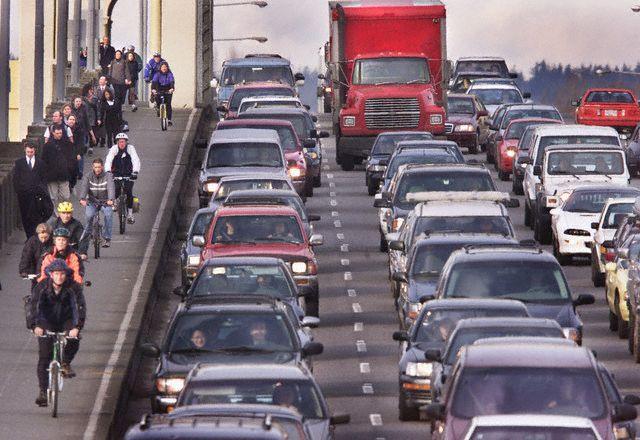

bike-commuter-1.jpgCycle to Work scheme payments to be VATable from next year

HMRC have announced that from 1 January 2012, VAT will be applicable on any payments made under the Cycle to Work scheme. This ruling is in response to a recent European Court of Justice judgement, and HMRC has confirmed that provision of a benefit via salary sacrifice to employees constitutes a supply of services for consideration and is therefore subject to VAT.

Got that? It's all a bit dry, this, but it's worth working through it to see what it'll mean if you're planning to get a bike from Cyclescheme, Halfords, Evans or one of the many other Cycle to Work providers.

As we understand it, the European Court of Justice judgement is essentially saying that since you'd pay VAT to hire a bike from a bike hire outlet, and you're effectively hiring the bike from your employer when you get a bike through a Cycle to Work scheme, VAT is applicable to that too. The employer has to 'account for the VAT', which means that they can pay it if they want rather than pass it on to you. But let's be realistic: that's not going to happen, is it?

So that's 20% of your saving out of the window? Well, no. Things never seem to be simple with Cycle to Work in the UK and this ruling, although it clarifies some things, is no exception. The VAT is applicable to the whole payment before tax and NI reductions, which means that the actual reduction in your saving is closer to 11%, according to David Sawday of Halfords, who spoke to us about the ruling and has done the sums that we're not clever enough to. "It's as much good news as it is bad", he told us. "The worst thing about the scheme is the uncertainty; we saw the effect on the scheme of the uncertainty over market value payments last year. This ruling allows us to ensure that we're running a compliant scheme for everyone".

The other good news is that if you work for an institution that hasn't been able to reclaim the VAT on bikes in the past – NHS trusts, for example, and some Government departments – our understanding is that the ruling will create a system by which the VAT can be reclaimed, so the employee will be able to have the bike at the ex-VAT price and pay the VAT on the monthly payments. So that'll mean they'll actually save more money, not less. The new ruling comes in to force on 1 January, so if you're planning to get a bike before that you won't be affected at all.

We like the Cycle to Work scheme, but this all makes our heads hurt a bit. We spend most of our days wondering why the scheme can't be like the Italian EcoIncentive one, where the Government just fronts a big pile of cash, and you get some if you buy a new bike, and when it's gone it's gone. But that would be much too simple...

Dave is a founding father of road.cc, having previously worked on Cycling Plus and What Mountain Bike magazines back in the day. He also writes about e-bikes for our sister publication ebiketips. He's won three mountain bike bog snorkelling World Championships, and races at the back of the third cats.

Latest Comments

- Safety 1 min 2 sec ago

Polis Scotland quite frankly are a disgrace. It seems that they treat cyclists with the same disdain that the Met have treated females.

- Bungle_52 9 min 5 sec ago

Re cycling to school. Perfect timing. https://www.gloucestershirelive.co.uk/news/cheltenham-news/boy-bike-hit-...

- slc 21 min 58 sec ago

Not Park St, but fairly near, in a region of the city that was essentially given over to heavy traffic infrastructure. ...

- brooksby 37 min 44 sec ago

Looks like local cyclists need to start going along there in primary position then…

- hawkinspeter 2 hours 5 min ago

I re-fuse to believe that not charging drivers is the current attitude

- chrisonabike 2 hours 50 min ago

Well, there are always recumbents!...

- Matthew Acton-Varian 3 hours 45 sec ago

Most modern cars, especially SUV's perform very badly on the Moose test. Essentially a stunt driver has to weave through tightly spaced cones at...

- Mr Blackbird 5 hours 17 min ago

His hands are too small to reach the brake levers and his tie gets caught in the chain.

- David9694 14 hours 58 min ago

Further to A Look at Logical Fallacies a couple of months ago. My theory is that 5...

- wtjs 15 hours 14 min ago

A dangerous, reckless and aggressive BMW driver. Who saw that coming?!

Add new comment

21 comments

I have used the scheme, but decided not to do so again. The pretty marginal savings do not offset the hastle of not owning your bike, and of technically not being sure wether you'll be offered it at the end of the hire period by cyclescheme.

There are all sorts of hidden costs. Insurance has already been mentioned. There is also the fact that for a £1000 cyclescheme voucher, the bike shop actually only gets £900, and naturally passes this cost on to the buyer. My shop was quite upfront telling me that he'd sell me the bike for £100 less if I didn't use the voucher!

On the plus side, if you earn between 100k and 113.5k, you can actually save nearly 70%, as the marginal rate of taxation there is 62%.

I got a Pashley Roadster BSO on cyclescheme way before the changes (all the savings I made paid for the numerous repairs on the piece of sh*t) and was considering doing it again and buying a proper bike when the HMRC threw their toys out of the pram. The EU aren't the real villains, it's the HMRC who have been doing their level best to kill this all off from the outset.

hm, that's not so great then, no, if they're doing it direct and aren't playing ball

Just got a letter from them. I can either return it, continue payments as previously or accept the bike as a benefit and pay tax on that benefit. An offer too good to refuse. Means my final payment will be about £25! Result.

It remains a simple way to buy at a good price (because of the income tax effect) and with salary sacrifice deductions it's a painless way to pay for a better bike than you would normally buy.

Extended mine by 30 months for a refundable £58. I'm guessing that this will be the bike's value at the end of the hire period, so I either hand it back for the refund, or keep it for free? As a higher rate tax payer it was originally a very attractive proposition...not sure I'd go for it again though. The cost of additional insurance over the full term of the hire wipes out quite a bit of the saving. As said previously, possibly better to go for a private EOL deal with interest free finance over 12 months.

Thank you Europe, once again, for nothing.

It does appear that the savings we all thought we were making are slowly being taken away from us. I simply do not understand our govt! The idea behind the scheme get more people on bikes, cheaper, healthier, less traffic congestion, the list goes on. But on the other hand scare everyone away from the scheme. My cycle to work scheme I signed up for finishes in a couple of months time I was thinking of extending it over the new rules or paying it off and going for another bike! I think now I will pay off the bike so I own it and pay for my next bike with my own money. At least it won't be subject to changes 6 months down the road...

A 7% payment at the death - where do you get that from? I've been told it could be 25% unless I can persuade my employer to extend the hire period. HMRC have wrecked the scheme and this latest ruling will mean even fewer taking advantage as savings will be minimal.

most of the major providers offer the extended hire as standard. Halfords and Cyclescheme certainly do, and it's a contract with them, not your employer, so there's no need to persuade anyone to do anything.

Mine is through my employer and, with one payment to go, I haven't yet heard whether they will be willing to extend the hire period.

I'm surprised that cycle retailers aren't kicking off at these changes, which will surely detract from the attraction of the scheme.

Having seen the Cycle to Work Alliance and Cyclescheme press releases today, they're both saying that the scheme can still offer savings of 'up to 42%'

That'll be a bike without VAT for an employee on the higher tax rate. A quick go on the current Cyclescheme calculator suggests you can save 52% at the moment, so the VAT looks like it will knock 10% off that saving.

I'm not sure whether lower rate tax payers will be affected to a greater or lesser extent, but assuming it's the same, you can save 43% now which equates to 33% next year. factor in a 7% payment to make it yours at the death and your overall saving is about a quarter. Still worth having, and the VAT stuff won't make it any more or less difficult for the end user.

And yes, make sure it's insured if you get one.

And if you do take out the cycle to work scheme, make sure you take out separate insurance for the bike, I've heard of people spending the best part of a grand on a bike, having it nicked and then being stuck with making the repayments and in a final kick in the nuts having to make the final payment in order to "own" the bike as they cant return it.

Some home insurances wont cover cycle to work schemes as the bike isnt your property.

I must be misunderstanding - but if the VAT is payable on the gross payments, then surely that means the VAT is more, not less? 20% of a £100 monthly payment is more than 20% of a £59, post tax and NI payment, no? Or am I looking at it the wrong way round?

As PhilWalker says, the benefits are getting so far eroded that most people would be much better off finding a good deal on a sale bike and buying that....

As I understand it (which is not fully): you're effectively paying the VAT on the pre-tax amount, but you don't pay the whole VAT bill from your own pocket, much like you don't pay the tax and NI.

David at Halfords said they'd worked it out at about an 11% contribution from your own pocket. I don't know how they worked that out so I can't say for sure it's correct, but suffice to say they've probably done more work on it than me...

Yeah, that gets way too complicated here! I wanted to get a new bike on the scheme, but after working out the total gain after a 12 month hire period, it was working out to be ridiculously small for the whole hassle on both me and my company.

There is just no way to justify *not* owning the bike and still have to pay 25% of it's initial value at the end of 12 months.

I had a £1000 voucher, I'm returning it and I'll be the rightful owner of my new bike from day 1.

Cycle scheme? No thanks.

Sad, it *was* attractive

They need to stop mucking about with this.

I've done it once, got burned by the market value changes and dealer (Brixton Cycles) gouging, ended up being the worst value for money bike I've ever bought. Not doing it again.

OK, fine, as long as they also start taxing that much more common and far more valuable "provision of a benefit": staff car parks.

They just can't bear to see good schemes continue... what is next? ask us to repay tax savings back? Im very very cross

The whole thing has turned into a farce now and may as well be scrapped. People are better off finding a good deal and getting the bike on Interest free finance over 12 months or whatever.

Yet again, the Government lets a good thing go to waste

These 'clarifications' meant my employer got bored with the whole thing and wandered off. No more scheme here, despite a high profile Green Agenda marketing campaign. Pfft.

Jesus, they don't like to make it easy do they? What started out as an excellent scheme to help people purchase a bike to use for commuting (well at least 50% commuting ;-)) has turned into a right ball-ache!

In some ways I'm almost glad that my employer hasn't signed up for this as it's the savings are fast disappearing in a pile of red tape!